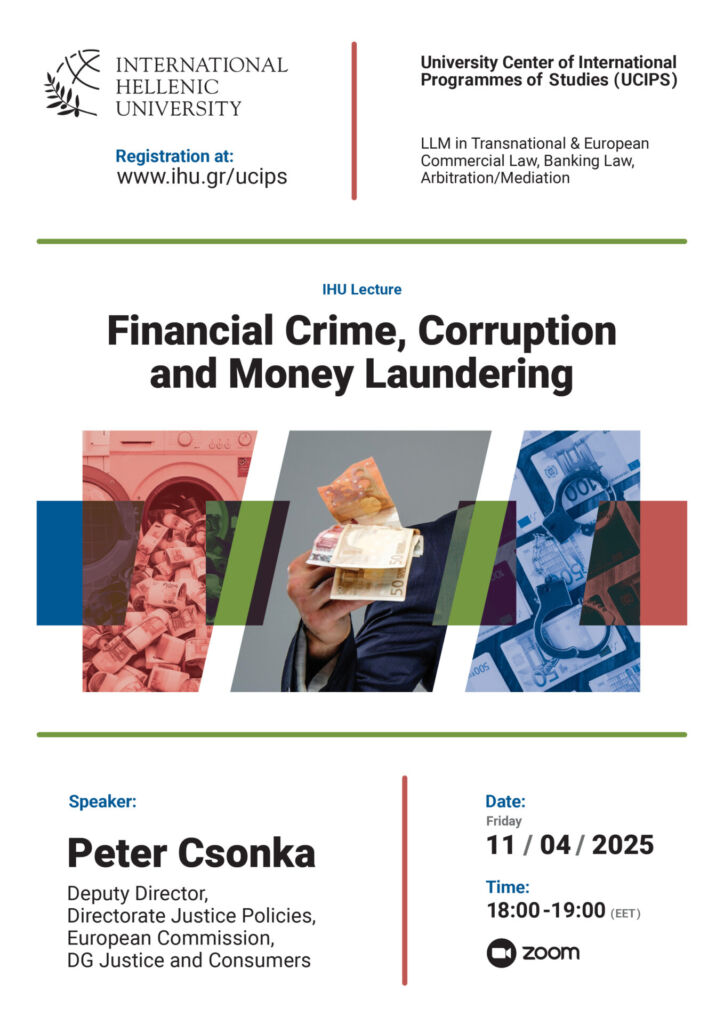

Financial Crime, Corruption and Money Laundering

The IHU lecture is organized by International Hellenic University, online, on Friday, 11/04/2025, time: 18:00-19:00 in the context of the “LLM in Transnational and European Commercial Law, Banking Law, Arbitration/Mediation”.

The IHU lecture will be offered through the zoom platform.

After the completion of registration, you will automatically receive the zoom link for attending the event.

Language: English